Save & Build: A Better Money Plan to Owning a House

BlogFriends,

In my discussions about investment options at an individual level in the Capital Market versus Real Estate, my emphasis on proper risk assessment (Goal-based) at an individual level and the liquidity needs or plans of many of us often paints me as a real estate skeptic.

However, my recent interaction with NEST Uganda regarding their Save & Build product they are offering to the Market has been quite enlightening and with it’s incorporation in a way that doubles down on both the Benefits of Capital Markets offerings and the Real Estate world.

This innovative solution addresses a significant gap in the Real Estate market. It not only offers increased liquidity through its unit trust savings (Nest Uganda has partnered with some of the Licensed Fund Managers to offer this product mix) model but also allows you to accrue interest towards your construction project.

This is the Goal-based Investment, where your goal is to Own a Residential House, allows you in the Short to Medium term to invest in a Capital Markets and earn interest towards the set goal and after a time frame, you move all that Total Investment to buy a House through their program.

Save & Build by Next Uganda Explained

What exactly is Save & Build?

It’s a program by NEST Uganda that enables you to contribute prepayments to your building fund via their Unit Trust account. This is particularly beneficial for those who plan to build but are unable to make lump-sum payments. It’s an incredible goal-based Investing type where in the first years, your Savings are earning interest of an average 10% per Year which also contributes to your construction project later.

How Does It Work?

Design Phase

A personalized architectural plan is created to reflect your preferences, outlining the structure and associated costs. If you haven’t yet purchased land or chosen a location, an estimate can be provided based on a design similar to your vision.

Financial Planning

At this stage, a Save & Build plan tailored to your budget is developed. This determines the minimum prepayment amounts. The budget and plan will differ for each individual and their respective timelines.

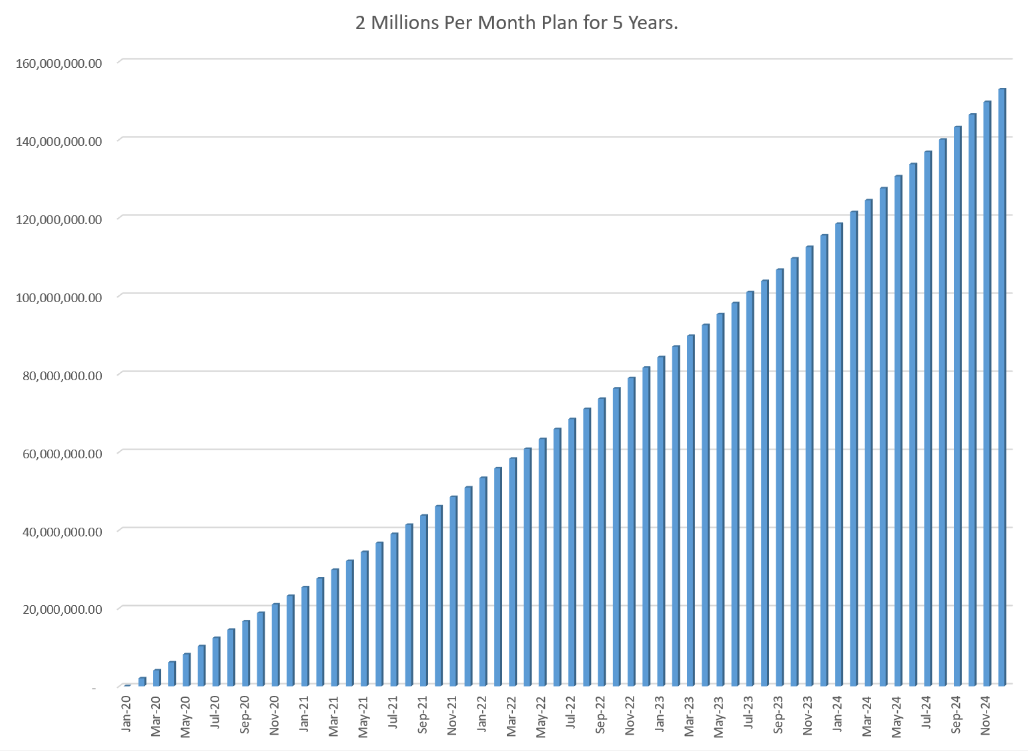

For instance, if you began saving UGX 2 million per Month in 2022, you would have accumulated approximately UGX 84 million by now, including interest. Starting in 2019 would mean you’d have UGX 156 million inclusive of Interest, potentially enough to fully fund certain construction plans.

This method allows your Money to earn interest per month for a period of time, which is then used in the construction of your dream house. A double win situation.

From the example above, the person who saves UGX 2 Million per Month for 5 years, would have an additional UGX 36 Million in interest income going towards the construction of their house.

Construction

Once you’ve reached the minimum amount required to start the project, construction begins. A project manager is assigned to each client to ensure transparency and accountability throughout the process.

I will be hosting NEST Uganda in an upcoming space, so please keep your questions ready for any further clarification.

For more information on Save & Build or NEST Uganda, feel free to reach out at X @nestugltd on WhatsApp, and I will be happy to share their contact details.

Happy Investing Everyone

Alex Kakande