More Ugandans Over 35 Years Old Renting

BlogMany of us by now have seen the Daily Monitor Headline for October 11, 2024, titled

Born To Rent

In this article, I bring back and explore the challenges faced by young people in Uganda who are trying to escape the rat race of Renting and owning a house.

Recently, I encountered a discussion from NEST (a real estate company) in Uganda on why Ugandans over 35 years old are not owning homes despite increased education levels and Incomes compared to previous generations, and I decided to share my thoughts on the matter.

Courtesy Photo.

Firstly, I am not against early home ownership as many of you might perceive. However, I urge Ugandans to analyze significant financial decisions like building homes beyond the emotions attached to home ownership by a certain age and making the right investment decision at any point in time.

Cost of financing a Home

Unless you are able to earn about UGX 10m or more a month as a Ugandan, in other words, if you’re in the Uganda A league, in which case this might not apply to you, the average Ugandan in the corporate or formal sector would need a loan to finance their home.

Now, the mortgage landscape here, compared to the rest of the world, is anything but favorable. The annual mortgage rates in most banks lie between 16-22%. Let’s see what that would look like in numbers for building a 3–4-bedroom house in the outskirts of Kampala.

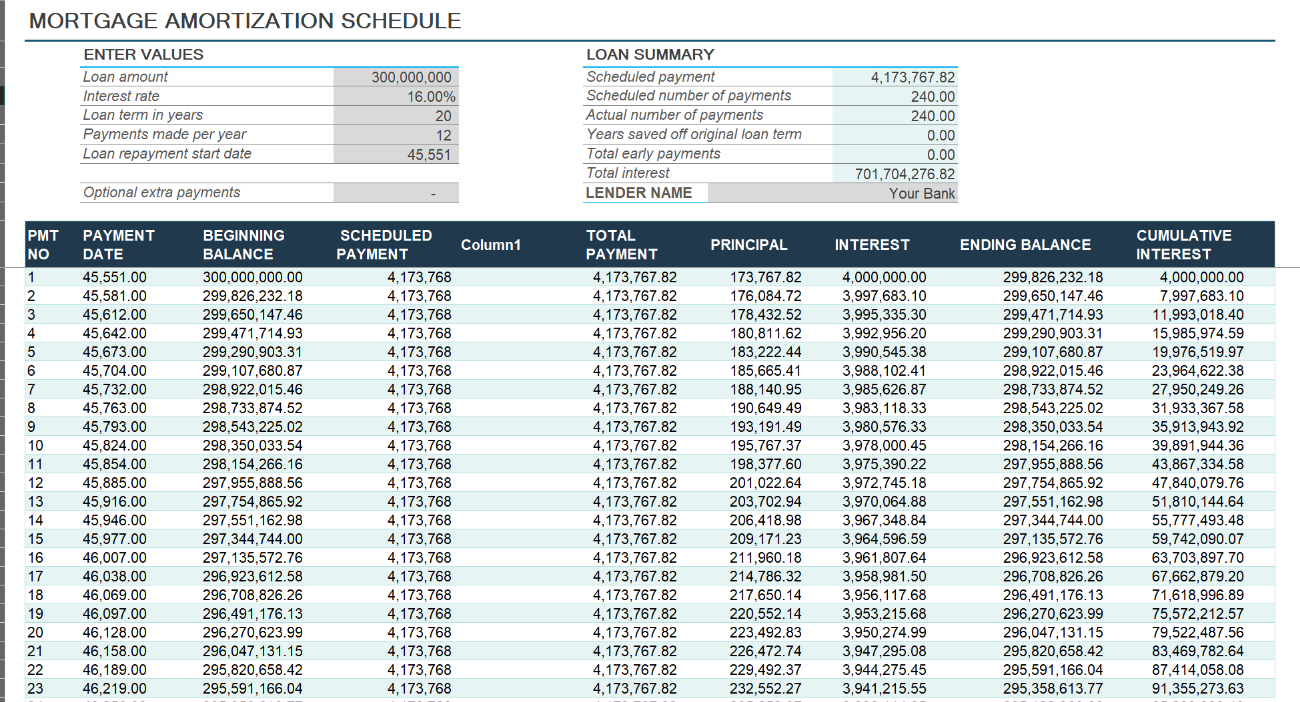

Computation of a mortgage worth UGX 300 Million with a loan repayment term of 20 years. (Which is even more unlikely in our Ugandan context)

A few issues to dissect here include interest of over UGX 700m.

This is over twice the borrowed amount, which is outrageous even with the inflation rates. Some may argue that the house values would have caught up, which I find too simplistic. Any proper analysis of this would have to take into account the costs of house renovation and depreciation over a lifespan of 20 years, the insurance, and incidental costs for acquiring the loan.

Monthly Payment (UGX 4m)

For most banks, the monthly payment required should be at least 50% of the customer’s net pay. In simple terms, you need to earn at least UGX 8m to qualify for this loan with most institutions. Even with bigger institutions, this salary band will leave out many people in middle management and below, which is ironic as these are the individuals ready to settle down and count on loans for their home construction.

Other factors, such as the risks of losing a job while paying the mortgage, fluctuation of interest rates on mortgages, and access to the loans, I will dissect on another day.

Supervision headaches

Another issue to consider is the headache of supervision. The over 30-year-olds who can access building loans have to be busy working 9-5 or longer and hence can’t be onsite supervising. On the other hand, the construction industry is considered to have the most crooks, from stealing materials to shady work and not honoring deadlines, to name a few. It is not surprising that people are opting to rent until they are comfortable with building and putting up with the strain that comes with it.

As someone over 35 years old, what has stopped you from building your home despite having worked for a while?

Happy Investing Everyone

Alex Kakande