Home Ownership Through Unit Trusts Investments

BlogFriends,

Recently, someone sent me a direct message in response to a post of mine that discussed the merits of investing in bonds and unit trusts versus real estate.

They asked, “Why invest in bonds or unit trusts instead of a home, when I can’t ‘sleep’ in bonds?” I was tempted to reply, “Actually, you can,” but I chose to take the high road and provide a more thorough explanation, building upon my previous analysis.

This exchange prompted me to consider how many of us lack awareness of alternative pathways to homeownership beyond traditional loans or brick and mortal way of monthly construction of homes for years.

In recognition of the individual who reached out, I’ve decided to share my insights and analysis on unit trusts model with a target of constructing a house versus construction loans.

Currently there are not many companies doing the Unit trust Model of Construction of a home I know of but I have interacted with but I have come to know NEST Uganda and their partnership with one of the regulated Fund Manager in Uganda.

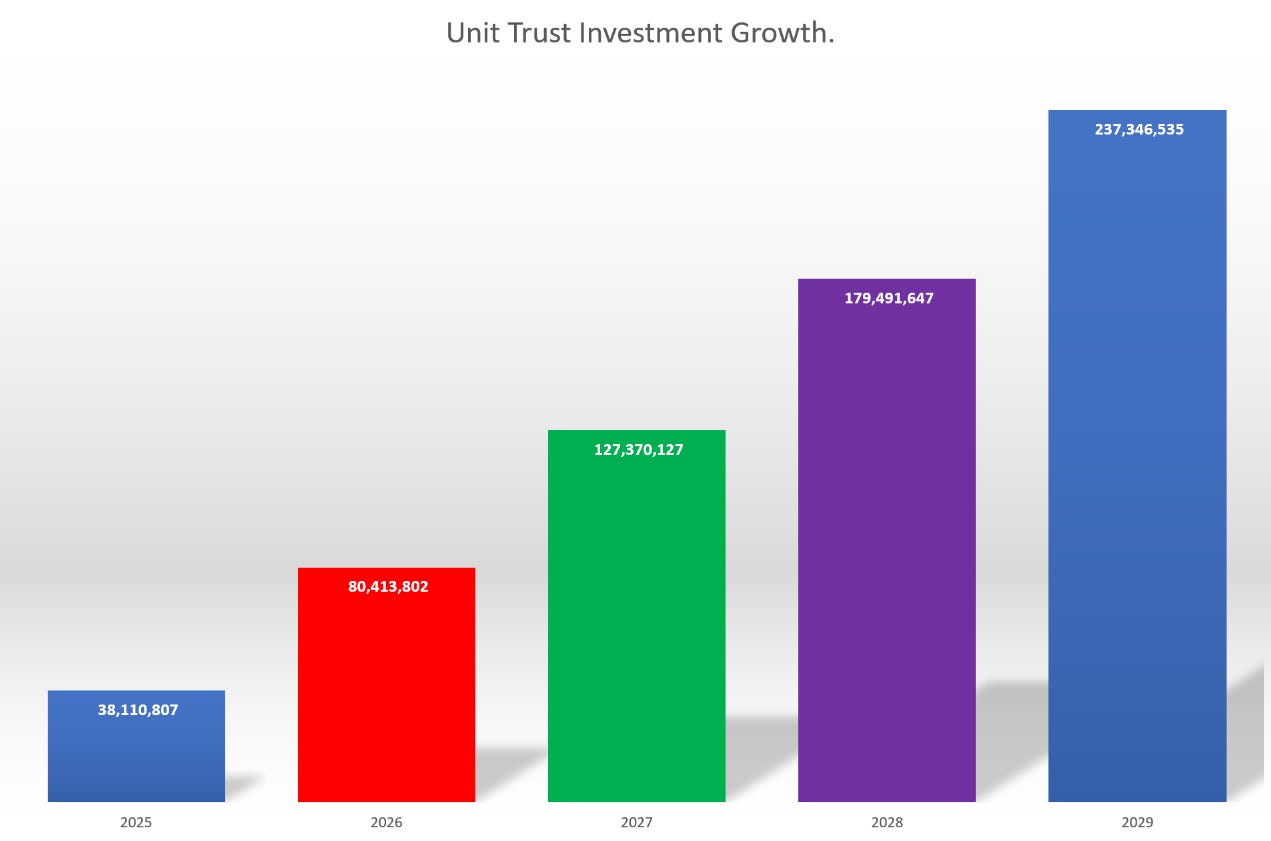

Consider someone aiming to construct a four-bedroom house valued at approximately UGX 200 million, with a monthly budget of UGX 3 million. Let’s explore what it would mean to choose the unit trust option as opposed to a building loan (mortgage).

The Unit Trust Model.

- Monthly Saving into the Unit Trust earns income and allows you to compound that after one year, the interest also goes to your capital project to use in constructing your home.

- Flexibility in contributions depending on your incomes and funds availability that targets your goal.

Assessment: The interest earned, amounting to around UGX 60.7 million, or about UGX 1 million per month, more than compensates for the rent paid and goes into helping you constructing your dream house and also helps you to add value to the Construction project.

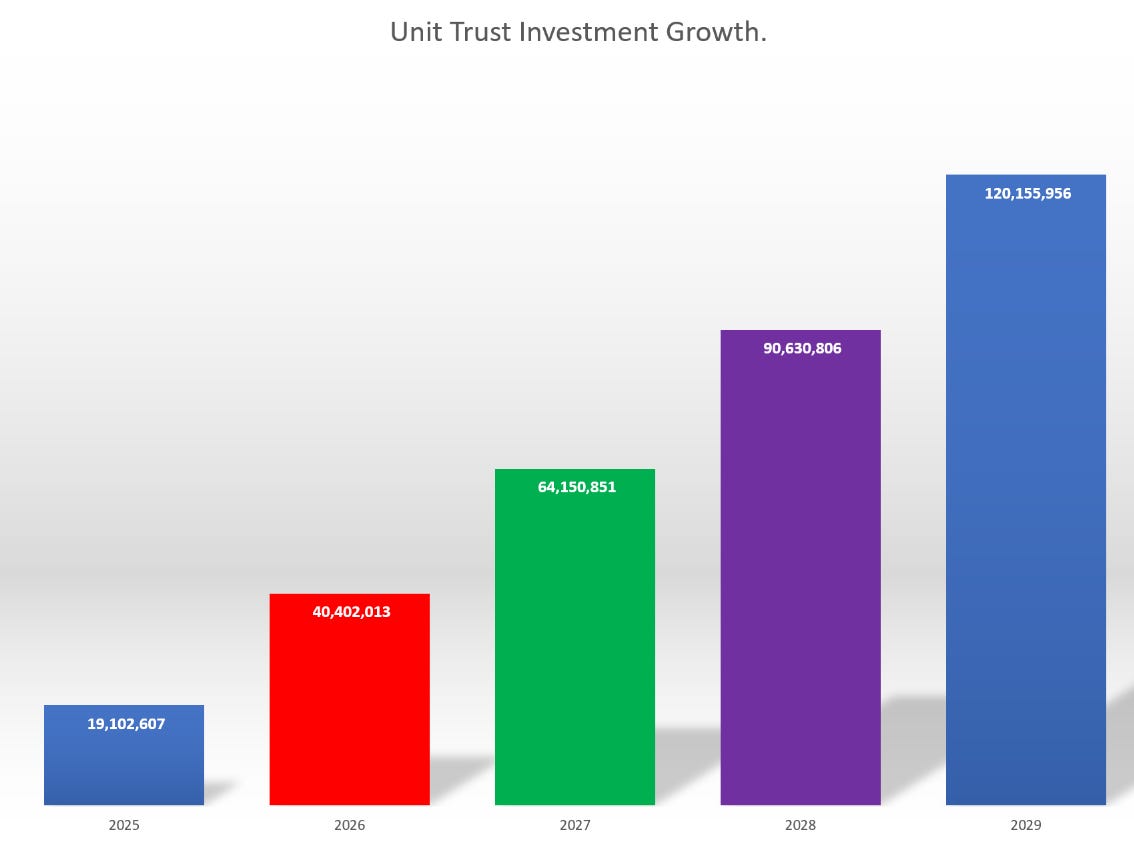

Or for those who might have less money, consider saving and investing 1.5 million per month, from saving a nominal value of around 90 million to obtaining a value add total of over 30 million and then going for a construction with UGX of 120 million which would do a big whole project, something that would boost the value of your project as compared to bits by bits kind of construction.

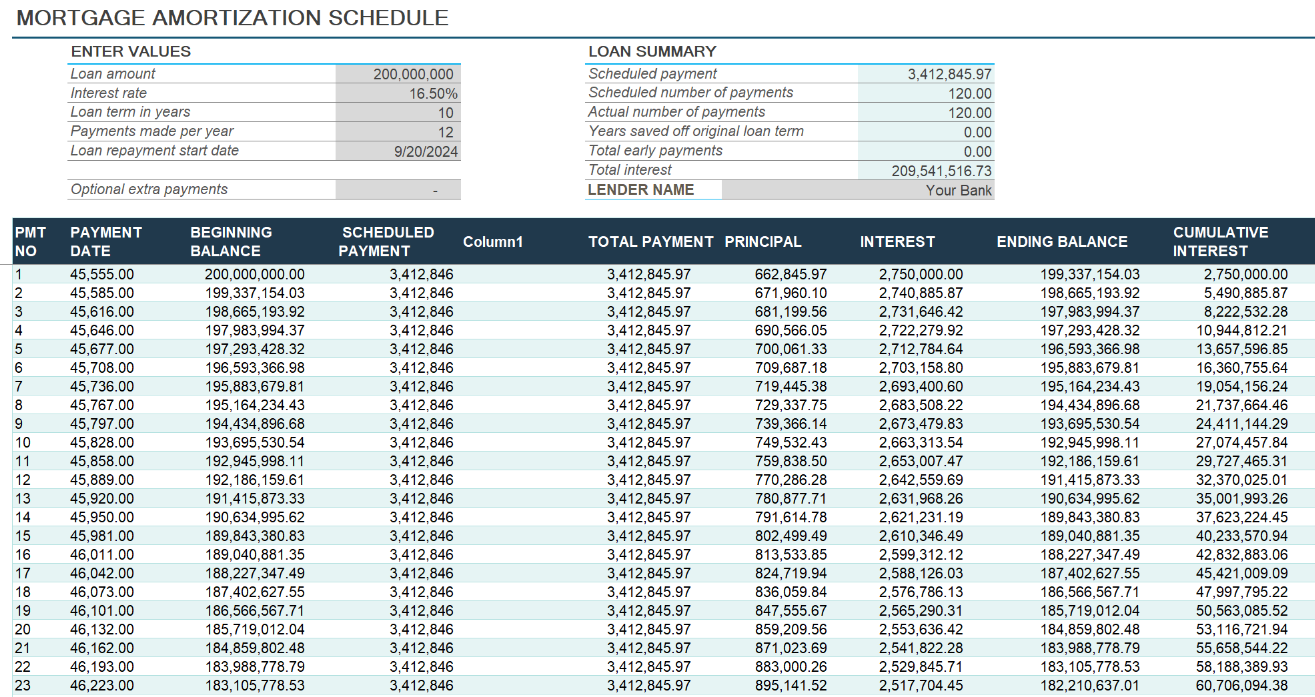

What about the Mortgage Loan.

Whereas the loans/mortgage route would help accelerate the construction project and save time, but the exorbitant interests being charged on loans makes the cost of the project way expensive and creates risk like, failure to pay the loan would lead to loss of property and equity invested.

From both a personal and professional standpoint, I believe that no amount of rent savings can justify paying interest that is being charged by Majority of commercial banks and the loan terms banks bring into this mortgage industry, especially with the added risk of losing the home if you face unemployment.

For my upcoming article on homeownership, I will review the Save & Build program by NEST Uganda (@nestugltd), which offers building plans for clients using a unit trust investment model.

Happy Investing Everyone

Alex Kakande